Losing is easy when you lack a plan.

As a young crypto market continues to play out its growth pattern of adoption and capitalization over the long term, the most immediate matter of pertinence for most still-engaged market participants to this point is likely to be ‘ how should I best be positioned ‘ for any renewed bullishness ahead.

There is no right or wrong answer to this question, just as there is no correct / incorrect answer to the type of shoes one might prefer, or the weather one enjoys most, or a favorite color. A better way to frame your approach towards achieving success in any financial market (& life, for that matter), may be instead to ask:

How best should I frame my mindset, for long term, consistent & sustainable success?

Thinking in Simplicity

Simply put: Simple is elegant.

‘ Money ‘ is simply stored time + energy, When you lose money, you’re wasting your life.

I’ve spent a great portion of my life as a programmer; In doing so I got very good at refactoring - minimizing needless code and making my routines (& thereby time) more efficient in the process. The concept of refactoring also carries over to life: The more you can automate anything for simplicity, efficiency & elegance (in markets, business, personal, etc) the more your time is freed up to focus on more productive things. As a bonus of working towards efficiency, your product/tool/thought process also becomes less prone to fragility; with less fragility comes less need for future iteration, as there are inherently less failure points in streamlined designs. Time + energy saved = more ‘ Money ‘ / Resources for future use. It’s a positive feedback loop.

In Practice …

Possibly the most intuitive way to introduce efficiency in your trading & investing life could be to think of it like one would a video game:

a) Play to win (mindset)

b) Turn cheat codes ‘ on ‘ (clear advantages/edges)

c) Learn from mistakes (iterative improvements over time)

Defining your ‘ edge ‘

The biggest advantage in crypto (& markets broadly) at the individual level, could best be summarized in 3 key areas: Information, Focus, & Vision.

Information Advantage …

In a project-based / altcoin context this could mean getting to know a team and community on a personal basis via familiarizing yourself with their work habits and financials, and acclimating to their roadmap / plans, etc. Reach out to them, ask questions & attend events such as twitter spaces. Strive to keep an open channel of communication and healthy work habits, as well as a positive reputation within & around the community. In a more broad sense, information advantages and asymmetries can also be cultivated by growing & optimizing your personal network of contacts both in & outside any industry.

Focus Advantage …

Improving focus by clearing out the clutter & noise in your life, as well as being a healthier person overall is a low-hanging fruit that anyone can easily implement in their lives to become a better trader & investor.

Benefits to a clear mind and healthy body include: better memory (required for adherence to goal setting & visualization), enhanced ability to synthesize abstract concepts, as well as improved motivation / positive mood; Morale is especially critical in hard & volatile markets that test patience and conviction. Asymmetric returns in any market are highest when the crowd is no longer engaged / interested.

Framework/Vision Advantage …

Developing a framework centered around realistic probabilities of success could pay dividends, both to keep you on track with your goals, as well as to provide reinforcement through visualizing their success into reality. In a trading/investing context, this could include setting reasonable expectations for your trades & ideas, ensuring that over the long term you realize a favorable chance of earning a positive gain vs net loss (i.e restricting trades to only those with favorable risk/reward probabilities allows you to ‘ bet ‘ enough to see your winning trades more than pay for any losses).

It sounds far-fetched, but many studies have confirmed the claim that simple exercises centered around repetition and reinforcement (especially in a visual context), can improve your ultimate chances of succeeding in any goal you set your mind to. A couple exercises to include in your routine could include:

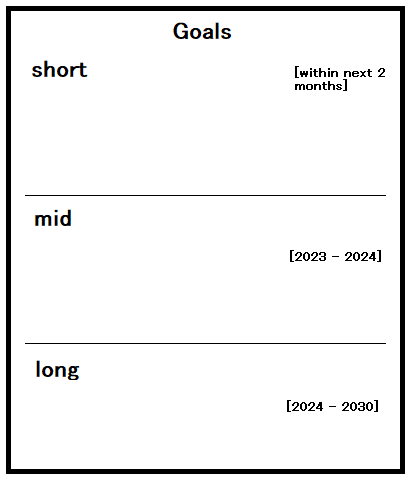

Defining personal Goals -

With a physical sheet of paper & pen, write down your short, mid, & long-term goals. Make them brief (2-3 goals each, with more detail given for short term goals vs long), & include rough time frames for achieving each.

Vision Board -

With a large physical poster board (single sheet or 3-tier column), create a ‘ Vision Board ‘ with all the items & aspirations you’d like to have in your future. These can be physical items (a house, a car, a pile of cash, bitcoin, etc), or more abstract things such as ‘ Happiness ‘ , more friends / family, exotic trips, work goals or job titles / salaries etc.

Simply cut/paste/draw whatever you are working towards onto the board. The simple act of creating a board with things we desire reinforces our goals; As well, it serves as a visual reminder into the future, to remind us what all our hard work is working towards.

With a clear mind, defined goals, information advantage & an optimized network - you set yourself up for success over the long term vs what most do (gambling on noise or popular shills at the time & hoping something sticks).

Gut Feel

Gut feel is also a great metric that you can use as a backstop. Harder to define as any single ‘edge’ - Gut feel may best be quantified as the summation of all prior experience; Tacit by nature, it’s something hard to pin down, but understood and experienced by each individual in their own unique way.

Human brains are simply natural pattern recognizers, experience teaches us to remember patterns from our past. When well-trained, we can better use these to not repeat the same mistake twice, & better assist us in choosing routes that lead to more favorable outcomes on average. Key to remember here is the old adage that history doesn’t exactly repeat, but often rhymes.

High-Level Narratives

In-line with our Focus & Framework advantages, in crypto, we should prioritize clearly defining which narratives may pay dividends for our participation (both with our time & resource capital). Below are a few high level narratives I really like:

Gaming - Gaming in the traditional sense (Web2) is a highly addictive hobby, with Web3 providing a perfect avenue for disruption. Web3 games have the inherent ability to integrate cross-game & cross-economy natively vs their Web2 counterparts. As well, by integrating QR, AR & VR technologies seamlessly, Web3 games hold key advantages in terms of projecting both physical & virtual assets in an augmented reality space. In game items, objects, characters & currencies can be easily swapped, traded, earned & shared - rewarding players more adequately for time investments spent, making these virtual realms potentially much more rewarding.

As with any addictive stimuli, moderation & awareness is important. The amount of addictive potential could vary grateful from person to person. From our view as investors, the addictive nature of gaming is a pro, as it ensures engagement & community participation remains high.

Arbitrum / ZKsync / L2 - There are significant pros to lowered cost, improved speed and finality in terms of blockchain interactions. Traders experience lowered friction during trades, end users of platforms experience a more snappy UI, and the overall ecosystem just functions better for all stakeholders involved.

Look for projects pivoting or innovating in these areas, but watch out for projects simply pivoting to take advantage of a ‘ pump ‘. The easiest way to filter for good projects vs bad again goes back to our edges: We need to familiarize ourselves with the teams behind the projects: The actual folks contributing, their plans, financials, etc. Following projects on Twitter & joining their official telegrams and asking questions (politely) are easy low-hanging fruit to start.

LayerZero / OFT - Omnifungible tokens have a clear advantage of vs tokens without cross-chain abilities natively, making them overall more useful & lower friction by default. For example, Radiant Capital (an OFT token), can be used cross-chain, allowing users that hold assets on 1 chain to borrow assets on a completely separate chain; Leveraging the usefulness of multiple chains cuts down on the need to use bridges, saves time/capital, & reduces redundancy & frustration for ecosystem participants and users alike.

Privacy - If you follow we are currently in the midst of a recession (in the macro-economic context), it follows that a significant push towards a CBDC(s) of some sort may follow by centralized governments & entities alike.

In this scenario, it’s likely a significant portion of time / energy / liquidity could be redirected to privacy narratives & innovation (necessity is the mother of invention). Look for teams and projects innovating in this area that make the process of owning & custodying privacy simple, reliable & efficient.

Memes - It’s human nature to love novelty, excitement & ‘ fun ‘. Many folks simply love to gamble, and crypto as an industry might be the perfect example of this (see leverage trading, $doge, meme coins, on-chain sports betting, gambleFi etc).

With this in mind, especially in more speculative frenzy times, we can 4d-chess the crowd by betting on their bets; Making small, well-planed & calculated ‘ risky ‘ bets on memes/gambles could pay dividends during a renewed crypto bull cycle; just don’t bet the house.

KG

Resources :

Visualization / Vision Board : https://jackcanfield.com/blog/vision-board/

LayerZero Twitter : https://twitter.com/LayerZero_Labs

Merit Circle Twitter : https://twitter.com/MeritCircle_IO

Radiant Capital Twitter: https://twitter.com/RDNTCapital